Top Accounting And Auditing Practices For Financial Accuracy

The Hidden Costs No One Talks About

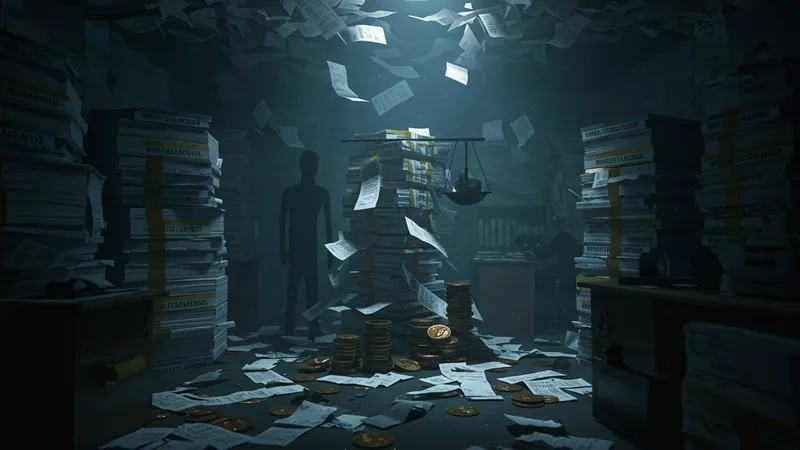

In the labyrinth of financial operations, one area often shrouded in mystery is the hidden costs that creep through poor accounting. Insufficient knowledge among staff leads to bloated expenses often masked under ‘miscellaneous’ categories. This is an aspect businesses rarely focus on, not realizing that clarity in financial reporting can unearth unexpected savings.

Did you know that improper categorization of expenses can inflate tax obligations by 20%? It’s true! By failing to accurately account for every dollar, companies inadvertently invite tax burden burdens that could have easily been avoided. Knowledge is power, and understanding these hidden drains on finances is key to prevention.

Unexpected details emerge when diving further — a simple misstep in bookkeeping can cost thousands in penalties. The shock doesn’t end there; managing such pitfalls frequently reveals long-ignored auditing practices that could transform your fiscal health. Ensuring compliance is just the beginning.

There’s an insider tip financial advisors swear by: quarterly mini-audits. Digesting your data doesn’t mean you have to hoard reams of paper; it means weaving through numbers to identify potential financial leaks before they become a flood. What you read next might change how you see this forever.