Top 5 Myths About Apartments / Real Estate

Debunking Risk Free Investment Myth

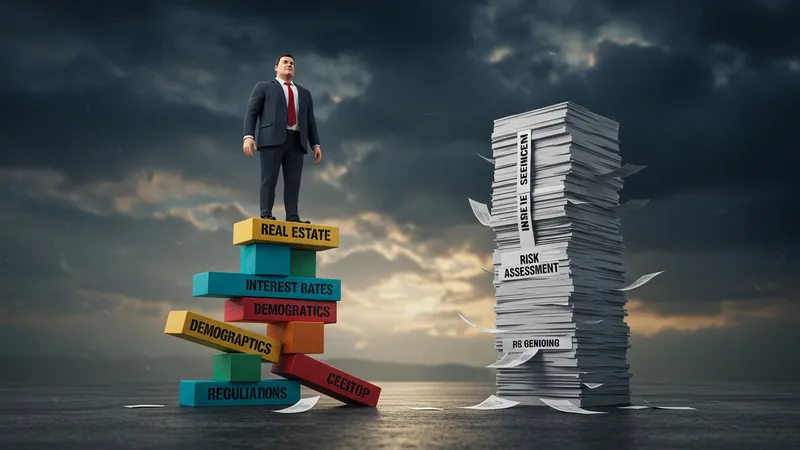

Real estate is often labeled as a risk-free investment, a perpetual upward assurer. Seasoned investors know better: economic shifts, regulatory changes, and demographic trends inject uncertainty into the equation. The enduring myth of no-fail investments is as storied as it is false. But the factors challenging this belief might shock you…

Amidst fluctuating interest rates, even traditionally safe investments display vulnerability. Recent instances of drastic market shifts have left unprepared giants reeling. Evaluating total risk exposure provides strategic insights. Yet, you won’t believe the next phase of this revelation…

There’s safety in diversification. Savvy investors leverage a range of assets to cushion against real estate slumps. This contradicts the age-old reliance on singular property strategies, evolving a comprehensive risk-safeguarding portfolio. But the enduring allure of singular dependency bewitches even the astute until reality permeates…

Overcoming the risk-free narrative involves realigning mental models towards resilience. The real estate market’s ebbs and flows ensure opportunity for those adapting to flux. Dispelling the risk-free fallacy opens strategic pathways seasoned by understanding market volatility. A once-simple myth unravels into a revelation of tangible risks skillfully mitigated.