Struggling With Tuition? Compare Student Loan Plans

The Game-Changing Power of Repayment Plans

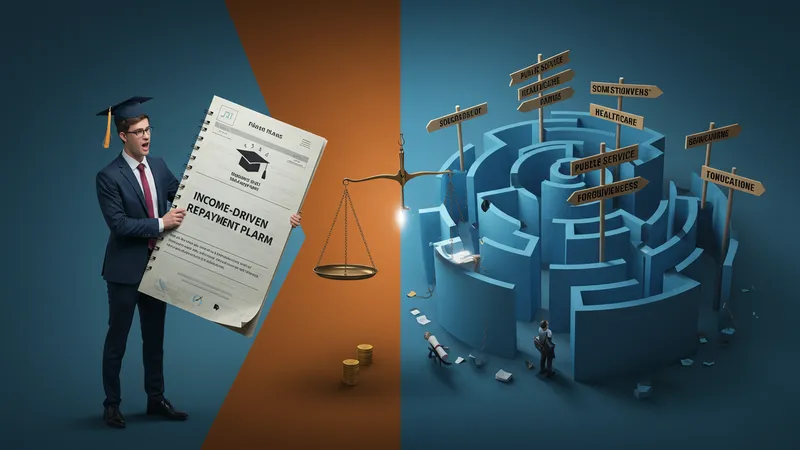

Your choice of repayment plan can redefine your financial trajectory. An income-driven repayment (IDR) plan, for instance, pegs your monthly payments to your income, offering relief to those fresh out of college. This flexibility is lifesaving, especially when starting out on a new career path with unpredictable earnings. Yet many overlook it in favor of traditional fixed plans, potentially missing out on valuable savings. Here’s where it gets really interesting…

Public Service Loan Forgiveness (PSLF) offers another breath of fresh air for graduates who work in specific sectors. Imagine fulfilling a service to society while gradually chipping away at your loan, with the promise of forgiveness after ten years of qualifying payments. However, the complexity of the eligibility criteria puts many off. But, understanding these nuances can mean the difference between drowning in debt or resetting your financial future.

On the flip side, some repayment plans include automatic graduation into new terms. If you sustain steady payments over time, you could automatically transition into a lower interest rate or reduced monthly payment scheme. This seamless transformation can free up funds for investments, savings, or other financial ventures. Yet, these benefits are often under-publicized. Still, there’s something else you shouldn’t overlook…

The merits of loan consolidation are widely advocated but with little understanding of the fine details. By bundling different loans into a single entity, managing payments becomes a streamlined process with potentially lower interest rates. But missteps in consolidating can mean missing out on federal forgiveness programs. Curious about how to make the most of these strategies? Keep reading for insider tricks and tips that’ll empower your choices.