Is Private Health Insurance In Egypt Really Worth The Cost?

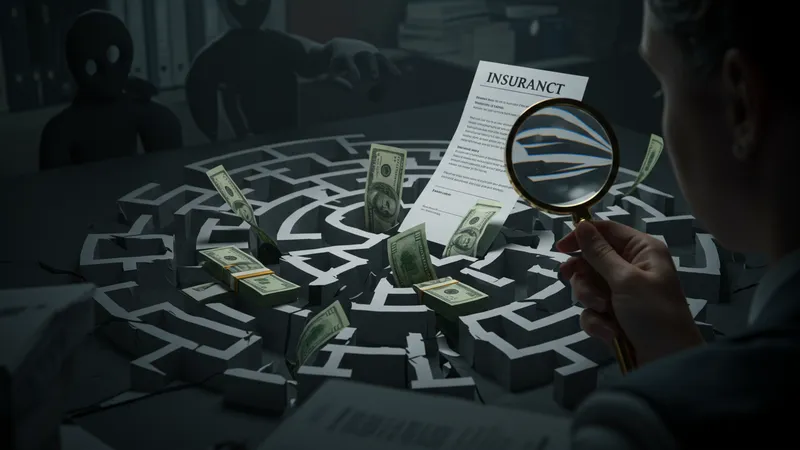

Hidden Costs Galore: The Charges They Hope You Don’t Notice

On the surface, private health insurance in Egypt appears relatively straightforward, but hidden costs lurk around every corner. Processing fees, service charges, and other surcharges are often buried in policy documents or emerge unexpectedly after a claim. These can quickly add up, turning what seemed like an affordable option into a financial burden. Yet this is just the tip of the iceberg…

Deductibles in many plans seem low initially but are calculated in such a way that even minor medical emergencies extract significant out-of-pocket expenses. Many users only realize the implications when hit by a hefty bill after routine check-ups or minor treatments. And just when you think you’ve figured out the math, a new twist throws yet another curveball.

Comparison between public and private insurers reveals a stark contrast. While public options often lack in speed and service, they provide more straightforward pricing without the hidden complexities. However, choosing between them is not as clear-cut as it seems. There’s another facet of the story to uncover.

A significant number of policyholders have reported surprise increases in their premiums after just the first year, often unrelated to claims made or personal health changes. These hikes are justified under complex jargon, familiar only to those deeply embedded in the insurance sector. The story doesn’t end here; there’s more to unravel about consumer protection—or lack thereof—in the wild world of Egyptian health insurance.