Is Private Health Insurance In Egypt Really Worth The Cost?

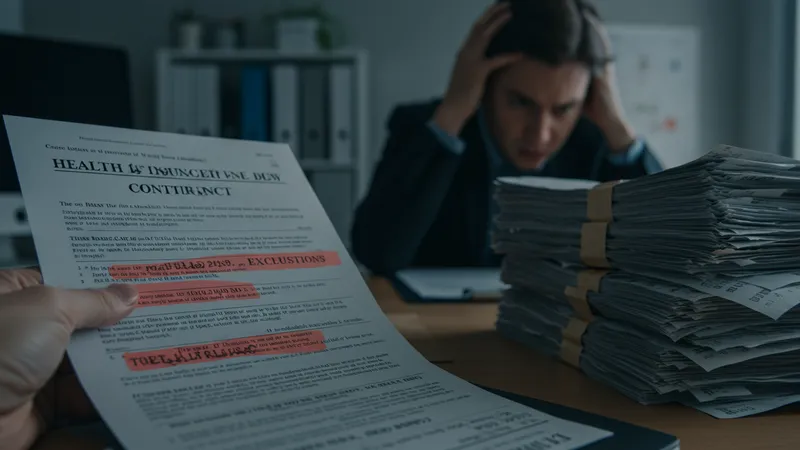

The Fine Print: What They Don’t Tell You

Private health insurance plans in Egypt often boast comprehensive coverage, yet the fine print reveals a different story. Many policies include clauses that limit coverage based on specific conditions or exclude certain treatments outright. These legal loopholes can leave policyholders footing massive medical bills, invalidating the purpose of having insurance in the first place. But there’s a hidden twist…

Some insurers include a waiting period for pre-existing conditions that can last up to a full year. During this time, any treatments related to pre-existing conditions aren’t covered, a reality many discover only once it’s too late. The industry’s claim of comprehensive coverage suddenly seems more like a mirage. What you read next might change how you see health insurance forever.

It’s not just individuals who face these challenges. Businesses providing insurance as a benefit often find the realities of coverage misaligned with their expectations. This leaves both company owners and employees navigating a murky world of approvals and denials. Digging deeper reveals another surprise layer…

The governmental regulation of private insurers in Egypt is more lenient than one might assume, raising concerns about the level of service and accountability. Without tight oversight, the personalization of plan offerings scatters, meaning one customer’s experience drastically differs from another’s. Just when you think you understand the rules, you realize there’s so much more hidden beneath.